In today's rapidly changing financial landscape, the environment of trading has changed significantly due to technological advancements. Traders are no longer restricted to conventional methods; rather, they have a abundance of tools at their fingertips. One of the most significant innovations in this field is the advent of trading software, which has transformed the way individuals and organizations navigate the financial markets. These applications not only streamline the trading process but also enable users to make more informed decisions.

Utilizing a strong trading system can enhance efficiency, minimize emotional bias, and provide critical market insights. If you are a seasoned investor or just starting, the advantages of trading software are clear. From automated trading strategies to real-time analytics, these systems offer a comprehensive approach to understanding the complexities of financial trading, making it simpler than ever to seize opportunities and handle risks efficiently.

Understanding Market Software

Trading applications includes a range of applications created to support traders in managing and executing their trades. These tools can analyze market data, streamline trading strategies, and provide insights based on past performance. With the growth of tech, traders now have access to advanced features that were once exclusive for professional investors, leveling the playing field for individual investors.

One of the major benefits of trading software is its capability to enhance the trading process. Traders can set up robotic trading systems that perform trades based on established criteria, diminishing the requirement for continuous market monitoring. This not only conserves time but also assists remove emotional decision-making during trades, allowing for more methodical approaches to investing.

Additionally, market software often includes assessment tools that assist traders form informed decisions. These tools can create charts, monitor performance metrics, and offer real-time market data. By utilizing these features, traders can spot trends, analyze risks, and optimize their trading strategies for superior outcomes. Finally, market software empowers users to improve their trading efficiency and performance, establishing it an essential asset in the current financial markets.

Key Features of Effective Trading Systems

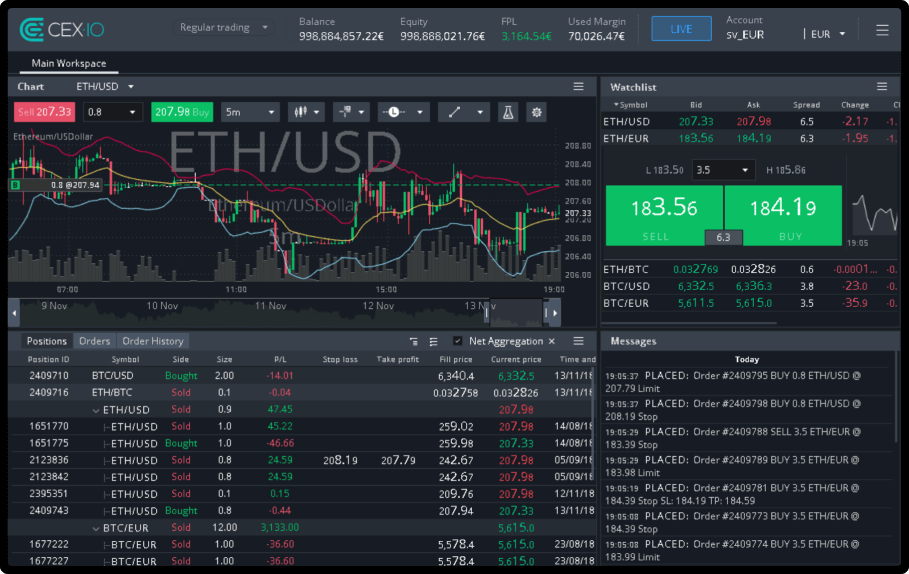

A effective trading system must have a user-friendly interface that enables traders of all experience levels to move through easily. A carefully crafted interface makes sure that users can access essential features and tools without unnecessary complications. This clarity can enhance decision-making processes, allowing traders to concentrate on strategies rather than fighting with complex software. Customizable dashboards that present relevant information at a glance further contribute to a more streamlined trading experience.

Furthermore crucial feature is the implementation of real-time data and analytics. A trading system that provides up-to-date market information enables traders to make knowledgeable decisions based on current trends and price movements. Advanced charting tools and indicators support detailed technical analysis, providing insights into potential market opportunities. With reliable data at their fingertips, traders can act swiftly to market changes, thereby improving their odds of success.

Ultimately, robust risk management features are essential for any robust trading system. These tools help traders establish limits on losses and define their risk tolerance. Automated alerts for predefined conditions can assist in overseeing trades efficiently. By embedding Tradesoft , traders can protect their investments and maintain discipline, which is vital for long-term profitability in volatile market environments.

Enhancing Gains with Technological Advancements

The implementation of trading software into investment approaches has changed the way investors approach the trade. By utilizing sophisticated computational models and real-time data processing, these tools can spot lucrative trading opportunities that may go unnoticed by individual investors. This mechanization not only saves time but also enables traders to make rapid decisions on information, maximizing their potential for profitability.

Furthermore, modern trading applications often come with capabilities such as risk management tools, historical testing features, and personalized notifications. These features allow traders to enhance their methods and make informed decisions based on historical performance. By utilizing technology, traders can minimize their exposure while maximizing their trading gains, providing them with a strategic advantage in a fast-paced financial climate.

In conclusion, the accessibility of automated platforms has made it more feasible for both inexperienced and experienced traders to engage in the markets. User-friendly interfaces and educational resources enable users to comprehend market dynamics and make strategic decisions. As a consequence, automation not only improves the potential for profit but also democratizes trading, allowing a greater number of participants to operate in markets efficiently and with clarity.